Office Business Expenses . mileage allowance payments (maps) are what you pay your employees for journeys made for business purposes. costs you can claim as allowable expenses. 10k+ visitors in the past month claiming business expenses is a simple way to keep your business tax eficient; looking for clarity on the allowable list of business expenses for uk tax? It reduces your profit which in turn reduces your corporation. but whether you’re a sole trader on the move or running a sme business from an office, there are a multitude of expenses that are allowable. Our detailed list covers office, travel, employee, and marketing expenses. Office costs, for example stationery or phone bills. If you’re one of the estimated 5.8 million uk small business owners wondering what you can claim, keep reading!

from templatelab.com

looking for clarity on the allowable list of business expenses for uk tax? If you’re one of the estimated 5.8 million uk small business owners wondering what you can claim, keep reading! costs you can claim as allowable expenses. but whether you’re a sole trader on the move or running a sme business from an office, there are a multitude of expenses that are allowable. claiming business expenses is a simple way to keep your business tax eficient; Office costs, for example stationery or phone bills. It reduces your profit which in turn reduces your corporation. 10k+ visitors in the past month Our detailed list covers office, travel, employee, and marketing expenses. mileage allowance payments (maps) are what you pay your employees for journeys made for business purposes.

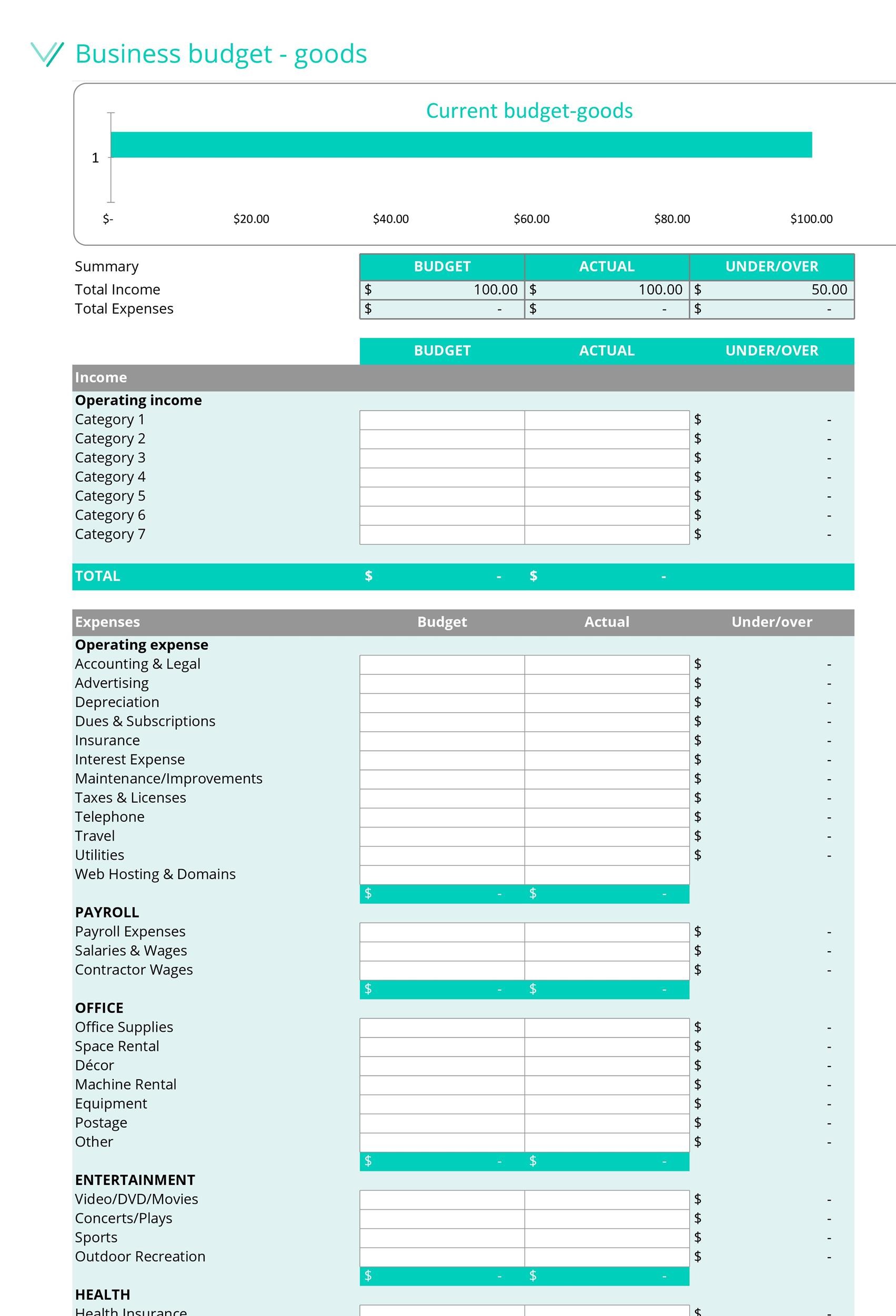

37 Handy Business Budget Templates (Excel, Google Sheets) ᐅ TemplateLab

Office Business Expenses mileage allowance payments (maps) are what you pay your employees for journeys made for business purposes. looking for clarity on the allowable list of business expenses for uk tax? If you’re one of the estimated 5.8 million uk small business owners wondering what you can claim, keep reading! claiming business expenses is a simple way to keep your business tax eficient; Our detailed list covers office, travel, employee, and marketing expenses. costs you can claim as allowable expenses. 10k+ visitors in the past month Office costs, for example stationery or phone bills. but whether you’re a sole trader on the move or running a sme business from an office, there are a multitude of expenses that are allowable. It reduces your profit which in turn reduces your corporation. mileage allowance payments (maps) are what you pay your employees for journeys made for business purposes.

From excelxo.com

Free Printable Business Expense Sheet — Office Business Expenses 10k+ visitors in the past month Our detailed list covers office, travel, employee, and marketing expenses. If you’re one of the estimated 5.8 million uk small business owners wondering what you can claim, keep reading! Office costs, for example stationery or phone bills. It reduces your profit which in turn reduces your corporation. but whether you’re a sole trader. Office Business Expenses.

From www.wordtemplatesdocs.org

28+ Expense Report Templates Word Excel Formats Office Business Expenses Our detailed list covers office, travel, employee, and marketing expenses. costs you can claim as allowable expenses. 10k+ visitors in the past month Office costs, for example stationery or phone bills. looking for clarity on the allowable list of business expenses for uk tax? If you’re one of the estimated 5.8 million uk small business owners wondering what. Office Business Expenses.

From www.sampletemplates.com

FREE 10+ Sample Lists of Expense in MS Word PDF Office Business Expenses Office costs, for example stationery or phone bills. If you’re one of the estimated 5.8 million uk small business owners wondering what you can claim, keep reading! costs you can claim as allowable expenses. claiming business expenses is a simple way to keep your business tax eficient; 10k+ visitors in the past month but whether you’re a. Office Business Expenses.

From www.sampletemplates.com

FREE 6+ Sample Budget Spreadsheets in PDF Excel MS Word Office Business Expenses mileage allowance payments (maps) are what you pay your employees for journeys made for business purposes. costs you can claim as allowable expenses. It reduces your profit which in turn reduces your corporation. claiming business expenses is a simple way to keep your business tax eficient; Office costs, for example stationery or phone bills. but whether. Office Business Expenses.

From www.teampay.co

The 7 Best Expense Report Templates for Microsoft Excel Office Business Expenses mileage allowance payments (maps) are what you pay your employees for journeys made for business purposes. Office costs, for example stationery or phone bills. It reduces your profit which in turn reduces your corporation. 10k+ visitors in the past month claiming business expenses is a simple way to keep your business tax eficient; If you’re one of the. Office Business Expenses.

From www.financialdesignsinc.com

Deductible Business Expenses for Independent Contractors Financial Office Business Expenses claiming business expenses is a simple way to keep your business tax eficient; looking for clarity on the allowable list of business expenses for uk tax? Our detailed list covers office, travel, employee, and marketing expenses. Office costs, for example stationery or phone bills. 10k+ visitors in the past month If you’re one of the estimated 5.8 million. Office Business Expenses.

From slidesdocs.com

Company Administrative Expense Budget Table Excel Template And Google Office Business Expenses If you’re one of the estimated 5.8 million uk small business owners wondering what you can claim, keep reading! looking for clarity on the allowable list of business expenses for uk tax? but whether you’re a sole trader on the move or running a sme business from an office, there are a multitude of expenses that are allowable.. Office Business Expenses.

From db-excel.com

Business Expenses Spreadsheet Template Excel Expense Basic for Office Business Expenses Office costs, for example stationery or phone bills. but whether you’re a sole trader on the move or running a sme business from an office, there are a multitude of expenses that are allowable. looking for clarity on the allowable list of business expenses for uk tax? If you’re one of the estimated 5.8 million uk small business. Office Business Expenses.

From monday.com

Free Excel spreadsheet for business expenses in 2022 Blog Office Business Expenses but whether you’re a sole trader on the move or running a sme business from an office, there are a multitude of expenses that are allowable. 10k+ visitors in the past month Office costs, for example stationery or phone bills. costs you can claim as allowable expenses. claiming business expenses is a simple way to keep your. Office Business Expenses.

From www.smartsheet.com

Free Excel Expense Report Templates Smartsheet Office Business Expenses looking for clarity on the allowable list of business expenses for uk tax? but whether you’re a sole trader on the move or running a sme business from an office, there are a multitude of expenses that are allowable. 10k+ visitors in the past month It reduces your profit which in turn reduces your corporation. If you’re one. Office Business Expenses.

From jjgals.blogspot.com

Monthly Business Expense Template Excel Free Patricia Wheatley's Office Business Expenses 10k+ visitors in the past month Our detailed list covers office, travel, employee, and marketing expenses. mileage allowance payments (maps) are what you pay your employees for journeys made for business purposes. but whether you’re a sole trader on the move or running a sme business from an office, there are a multitude of expenses that are allowable.. Office Business Expenses.

From templatearchive.com

30 Best Business Expense Spreadsheets (100 Free) TemplateArchive Office Business Expenses If you’re one of the estimated 5.8 million uk small business owners wondering what you can claim, keep reading! Our detailed list covers office, travel, employee, and marketing expenses. It reduces your profit which in turn reduces your corporation. costs you can claim as allowable expenses. 10k+ visitors in the past month looking for clarity on the allowable. Office Business Expenses.

From www.excelwordtemplate.com

Expense Report Template Excel Word Template Office Business Expenses costs you can claim as allowable expenses. looking for clarity on the allowable list of business expenses for uk tax? claiming business expenses is a simple way to keep your business tax eficient; It reduces your profit which in turn reduces your corporation. but whether you’re a sole trader on the move or running a sme. Office Business Expenses.

From db-excel.com

business expenses template free download 1 — Office Business Expenses Office costs, for example stationery or phone bills. but whether you’re a sole trader on the move or running a sme business from an office, there are a multitude of expenses that are allowable. looking for clarity on the allowable list of business expenses for uk tax? If you’re one of the estimated 5.8 million uk small business. Office Business Expenses.

From db-excel.com

Example Of Business Budget Spreadsheet Office Business Expenses looking for clarity on the allowable list of business expenses for uk tax? It reduces your profit which in turn reduces your corporation. Our detailed list covers office, travel, employee, and marketing expenses. 10k+ visitors in the past month If you’re one of the estimated 5.8 million uk small business owners wondering what you can claim, keep reading! . Office Business Expenses.

From db-excel.com

Examples Of Business Expenses Spreadsheets — Office Business Expenses 10k+ visitors in the past month claiming business expenses is a simple way to keep your business tax eficient; If you’re one of the estimated 5.8 million uk small business owners wondering what you can claim, keep reading! Office costs, for example stationery or phone bills. but whether you’re a sole trader on the move or running a. Office Business Expenses.

From www.exceltemplate123.us

11 Excel Templates for Expenses Excel Templates Office Business Expenses looking for clarity on the allowable list of business expenses for uk tax? 10k+ visitors in the past month mileage allowance payments (maps) are what you pay your employees for journeys made for business purposes. Our detailed list covers office, travel, employee, and marketing expenses. but whether you’re a sole trader on the move or running a. Office Business Expenses.

From www.sampletemplates.com

FREE 16+ Sample Business Budget Templates in Google Docs Google Office Business Expenses If you’re one of the estimated 5.8 million uk small business owners wondering what you can claim, keep reading! It reduces your profit which in turn reduces your corporation. claiming business expenses is a simple way to keep your business tax eficient; costs you can claim as allowable expenses. mileage allowance payments (maps) are what you pay. Office Business Expenses.